Summary

With WFAA’s recent launch of a new financial system FAST, some of our articles may be out of date. We are working to make updates as soon as possible. Please contact help@uwadvancement.org if you have any questions.

Within the Gift and Fund Management website, you can view fund detail information as well as create a variety of reports. This shows you more about what information can be found about a fund and various reporting available to you.

Key Takeaways

- Details of a Fund(s)

- Financial Reporting of a Fund(s)

- Other Reporting of a Fund(s)

- Such information is confidential and may only be used in accordance with WFAA’s polices, including its data disclosure and confidentiality policies.

Within the Gift and Fund Management website, you can view fund detail information as well as create a variety of reports. To access either fund information or available reports, log in to Gift and Fund Management, and navigate to Fund Reporting > Fund List/Information.

Definitions

- Accumulated market appreciation/depreciation: Increase or decrease in earnings of the book value.

- Cash to be endowed: Asset account 1010, 20-1010 or 30-1010. Money in this account is from donations intended to increase the value of the endowment and is held in the account until the quarter is closed. It is then transferred to the Fund Book Value account, 1150.

- Date entered: The date the gift was processed by WFAA Gift Services staff.

- Endowment book value: The total of all gifts and reinvested income received since the fund was established. The principal cannot be spent unless specifically allowed by the donor in the memorandum of agreement.

- Estimated annual income (EAI): An estimate of the interest expected to be accrued on the endowment in the next 12 months, based on the previous quarter’s interest payments made. The EAI is only an estimate and cannot be guaranteed by WFAA.

- Net asset class (NAC): References the distinction between permanently restricted, temporarily restricted, and temporarily unrestricted.

- Permanently restricted: Net asset class with prefix “30.” The endowment fund has a portion of the funds that are required to be retained permanently either by explicit donor stipulation or by the State Prudent Management of Institutional Funds Act (SPMIFA).

- Spendable cash: Asset account 10-1000, 20-1000 or 30-1000. Money within the account can be used for the intended purposes of the fund at any time by authorized users. Also Cash – ST Spendable.

- Spend plan cash: Posted to the 1005 (Spendable Endowment Income) account in all 132 funds. This posting represents quarterly income based on our Board Approved WFAA Spend Plan policy and can now be viewed as a direct deduction from the 1160 Market Value account.

- Temporarily restricted: Net asset class with prefix “20.” The money within a temporarily restricted NAC can be spent. The portion of the endowment fund subject to a time restriction under SPMIFA.

- Total endowment market value: A sum of the Endowment Book Value and the Accumulated Market Appreciation/Depreciation.

- Unrestricted: Net asset class with prefix “10.” The money within an unrestricted NAC can be spent down to zero.

On the Fund Reporting/Fund List/Information page, you will have access to:

- Fund Details — displays information relating to the fund such as fund name and number, start and end date, unit/department/division where the fund is assigned, etc.

- Financial Information — displays fund balances from the previous day

- Fund Description — includes a description of the fund and its purpose

- User Access — enables you to see other individuals with access to view the fund

- Fund Report Recipients

- Donor Bio — displays biographical information for the donor

- Documentation — displays links to fund documentation

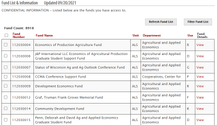

Filter Funds

It’s helpful to filter funds to find the specific ones you’re looking for. This is also necessary if you’re searching for funds in various departments or units.

1. Navigate to Fund Reporting > Fund List/Information.

2. The page lists the funds for all departments and units assigned to your profile.

3. To filter your results for this unit, click Filter Fund List.

4. In the window that opens, you can filter your results by searching for a specific fund number or name. You can also select a specific unit, department, use, class, or division. Searching for the fund number or fund name will search across all units and departments; similarly, you can narrow your search to several discrete units or departments.

Tip: hold Ctrl+click for these selections to select more than one unit, department, etc.

After making your selections, click Apply Filter.

5. After filtering your fund list, use the check box next to the fund name to select it. You can see how many funds you’ve selected beneath the list of funds.

Note: You can select up to 2,000 total funds on which to run a report.

Financial Fund Reporting

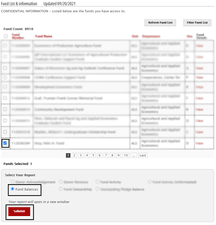

There are three financial reports within Gift and Fund Management.

- Fund Activity — detailed look at the accounting ledger of a particular fund

- Fund Activity (Unformatted) — detailed look at the accounting ledger of a particular fund with all formatting removed

- Fund Balances — summary of the balances in the main asset accounts of a fund

Fund Activity Report

The Fund Activity Report shows transaction details in an asset account. This includes the following:

- Spendable Cash

- Spendable Endowment Income

- Cash to be Endowed

- Endowment Book Value

- Cumulative Fund Value Adjustment

- Other asset accounts, if applicable (e.g., stocks held, pledges receivable)

The report may be requested for any date from 1992 to the present.

Run a Fund Activity Report (formatted and unformatted)

The formatted report organizes fund activity by account category (e.g., Spendable Cash, Spendable Endowment Income). Each category includes a beginning balance, a list of activities, and an ending balance.

The unformatted report does not summarize account categories. It does provide additional information (see the table below).

To create a report:

- Select the fund or funds for which you’d like information.

- In the “Select Your Report” box, choose Fund Activity or Fund Activity (Unformatted) and click Submit.

A new window will open. Enter the report Begin Date and End Date, then click the Create Report button.

Note: If your report does not open, check whether your browser blocks pop-ups and disable pop-up blocking for the site.

If your reporting dates are more than a year in length, the report will be emailed to you. Otherwise, your selected funds display in a table at the bottom of the page.

Click Export All to Excel to save the report for analysis or printing. All selected funds will be included in the report.

Viewing the Report

If your report timeframe is less than a year in length, you can click the Details link next to a fund at the bottom of the page. This action presents an Account Category field for selecting different accounting information types to display in your browser. You are also given an Export Fund Details to Excel button that generates a file of all accounting information for the specific fund.

What Is Included in the Fund Activity Report

| Field | Description | Notes |

| Fund Number | Unique numeric identifier for the fund. |

|

| Fund Name | Full name of the fund. |

|

| Sort Name | Name used to order funds more efficiently. Often based on the donor’s last name. |

|

| Unit | The school or college associated with the fund. | Appears only in the unformatted report. |

| Department | The department within the unit. | Appears only in the unformatted report. |

| Fund Class | Indicates whether the fund is an endowment or callable fund. | Appears only in the unformatted report. |

| Use Description | Identifies what the fund can be used for or how the money can be spent. Descriptions of use codes are found here. | Appears only in the unformatted report. |

| External Reporting Category | A custom reporting code that allows campus units to view and analyze the report in a way that is more conducive to their business processes. | Appears only in the unformatted report. |

| Account Number | Code used by finance to identify accounts within the fund. |

|

| Account Code Description | The name of the account within the fund. |

|

| Journal Type | A code that describes the type of transaction. A list of journal codes is found here. |

|

| Pmt# for HA/AP | The check number for e-reimbursement, Board of Regents checks, or checks to outside vendors. |

|

| Transaction Description | A description of what is being paid or reimbursed. | |

| Payee Name | Who or what is being paid or reimbursed. |

|

| Invoice Description for AP | A description of what is being paid or reimbursed. |

|

| Transaction Date | The date the transaction was posted to the accounting system. | |

| Transaction Amount | The amount of the transaction. |

|

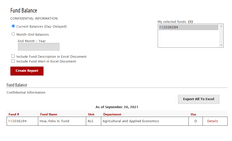

Fund Balances Report

A fund balances report displays the balance in a fund. This includes spendable cash, income, and endowments (current as of the previous month or most recently closed quarter).

1. Log in to the Gift and Fund Management website.

2. Select Fund Reporting > Fund List/Information.

3. Select at least one fund. Choose Fund Balances below the list of funds and click Submit.

Note: You must have your pop-up blocker disabled to access the report. Because fund reports open in a new window, a pop-up blocker will prevent you from creating reports.4. Select an end date for the fund balance report. Click Create Report.

4. Select an end date for the fund balance report. Click Create Report.

5. You can also export the report to Excel using the button above and to the right of the report.

Parameters

| Parameter Name | Description | Example | Notes |

| Current Balances | Runs the report based on the fund’s previous day’s balance. |

| There is no option to select a date other than the current date. |

| Month-End Balances | The last date of a previous month. | 1/31/xx 2/28/xx | Any month/year can be selected, but it must be the last day of the month. If no date is selected or today’s date is selected, the report parameter will adjust to the most recent month end. |

Report Details

| Field Name | Description | Example | Notes |

| Fund Number | Unique numeric identifier for the fund. | 112003456 | Funds beginning with 112 indicate callable funds. Funds beginning with 132 indicate endowed funds. |

| Fund Name | Full name of the fund associated with the fund number. | Department of Chemical Engineering Chair’s Fund Laura Nelson Kittleson Scholarship Fund | |

Sort Name | Full name of the fund formatted as Fund Name, School/College/Department Name or Donor Last Name, Donor First Name Remaining Fund Name. | Chemical Engineering Chair’s Fund, Department of Kittleson, Laura Nelson Scholarship Fund | |

Start Date | The date the fund was established. | ||

Unit | The school or college associated with the fund. | College of Engineering |

|

| Department | The department within the school or college. | Chemical Engineering |

|

| Use | The use code denotes a general idea of how the fund can be spent based on the underlying agreement. | A = Chairs and Professorships R = Research P = Programs C = Undergraduate Student Financial SupportD = Graduate Student Financial Support E = Faculty Support G = Public Service H = Research Equipment J = Discretionary S = Professional Student Support Z = Other |

|

| Fund Groups | Groups funds with commonalities. | Great People Scholarship Resident and Fellowship Funds |

|

| External Reporting Category | Allows schools/colleges to classify funds according to their reporting needs. | ATH: Kohl Center Suites & Club Suites EGR: Consortia | Contact the Help Center to learn more. |

|

Administrator |

Main WFAA fund contact. |

|

|

|

Principal Investigator | UW–Madison faculty/staff member responsible for spending from the fund. Applies mainly to research funds. |

|

|

| Fund Class | PERM — Applies to endowed funds. Only spendable endowment income may be spent. TEMP — Applies to callable and endowed funds. Fund restricted to a particular purpose and may be spent in its entirety. UNRE — Mainly received through bequests, and applied to callable and endowed funds. Funds that are to be used for the greatest needs of the university and spent in their entirety. | Callable-TEMP Callable-UNRE Endowment-PERM Endowment-TEMP Endowment-UNRE | |

| Spendable Cash | Represents funds that can be spent in accordance with fund purpose. | ||

| Spendable Endowment Income | Represents funds that have been transferred based on the spend rate allocation. | ||

| Cash to Be Endowed | Represents donations received for endowed funds. Will be used to buy units in the endowment pool during the quarter close cycle. Such amount will be added to the book value of the fund. |

|

|

|

Outstanding Pledge Balance |

Represents amount remaining to be paid on original pledge amount. |

|

|

| Estimated Annual Income | Step 1: current market value divided by current unit value = number of units Step 2: number of units multiplied by average income per unit times 4 (represents 4 quarters) = EAI excluding Cash to be Endowed balance Step 3: Cash to be endowed balance divided by current unit value = additional number of units Step 4: Number of additional units multiplied by most recent average income per unit multiplied by 3 = EAI on cash to be endowed balance (Note: Such cash balances will not be endowed until the next quarter.) Step 5: Total EAI = EAI calculated in Step 2 plus EAI calculated in Step 4 = total EAI | Illustrative Example — Revised EAI calculation Data points:

Calculation: Step 1: $100,000 / $1,173.5773 = 85.210 units Step 2: 85.210 x $14.6838 x 4 = $ 5,004.83 Step 3: $12,000 / $1,173.5773 = 10.225 units Step 4: 10.225 x $14.6838 x 3 = $450.43 Step 5: $5,004.83 + $450.43 = $5,455.26 | Key Definitions: Current MV = Represents the current market value. This value is the sum of the Book Value (1150) and Cumulative Fund Value Adjustment (1160) accounts. Current Unit Value = Represents the most recent quarter-end unit value. For example, if you are looking at the EAI on a fund on May 20, the current unit value will be as of 3/31/xx, the most recent closed quarter. Average Income per Unit = Represents the 16-quarter average of unit values. Cash to be Endowed Balance = Represents funds waiting to be endowed at the end of the quarter, which are not included in the current market value. |

| Endowment Book Value | Represents gifts received into the fund as well as funds moving into a fund via an accounting transfer. |

|

|

| Cumulative Fund Value Adjustment | Represents the earnings (including unrealized gain/loss) of a fund. |

|

|

| Total Endowment Market Value | Represents the sum of a fund’s Book Value and the Cumulative Fund Value Adjustment accounts. |

|

|